Innovation is the lifeblood of sustainable growth and a major driver of competitive advantage. Eighty-four percent of executives view innovation as essential, but only 6% are satisfied with their results. This stark gap reveals that traditional ROI (Return on Investment) measures don't fully capture the full potential of innovation.

Innovation is full of uncertainty, requires a long-term perspective, and generates value that often doesn't deliver immediate financial returns. Transformative innovations typically take 3 to 5 years to start paying off; however, the pressure to show quick quarterly returns often pushes leaders to focus solely on small and incremental improvements. As a result, breakthrough ideas get left behind.

Forward-thinking companies like Tesla and Airbnb measure success through non-financial indicators, such as emissions reduction and trust metrics, before profits materialize. As we enter an era of AI and rapid pace, it is essential to redefine innovation success metrics.

In this guide, we will discuss innovation metrics beyond ROI that can help your organization better track the success of your projects.

Why ROI Falls Short for Innovation

Innovation projects and standard business operations are different. In business operations, it is easier to rely on the ROI metric because these activities involve predictable processes and outcomes with shorter timeframes.

For example, a manufacturing company might spend $50,000 on a new machine that boosts production efficiency. This results in an additional $80,000 in revenue over the year. The ROI calculation is simple, resulting in a 60% ROI. When it comes to ROI for innovation projects, we cannot simply divide the net profit by the investment cost, as innovation involves greater uncertainty and a longer time horizon.

The following points will help you better clarify why ROI falls short for innovation:

The Uncertainty Gap

Innovation is uncertain because it involves experimenting with new ideas and testing hypotheses, which often yield unpredictable outcomes. This makes it very difficult to predict financial returns upfront or measure them using conventional ROI methods.

For example, Best Buy faced a downturn in 2002 and decided to invest in innovating its business model through creating the Geek Squad consumer support service. Although this move was risky and uncertain, it paid off by differentiating Best Buy from its competitors. The initial financial returns were unpredictable, but this innovation helped the company gain new growth opportunities over time.

In short, the uncertainty of innovation challenges traditional ROI measurement, as success often requires embracing risks and unknown outcomes before returns materialize.

Time Horizon Mismatch

Return on investment prioritizes short-term gains, which are often aligned with quarterly or annual reporting cycles. However, transformative innovations typically require a more extended timeframe of 3 to 5 years to mature and generate significant financial returns.

For example, consider a pharmaceutical company investing in breakthrough drugs. It must undergo a lengthy development cycle, involving extensive research, clinical trials, and regulatory approvals, before the product reaches the market and generates revenue. This can take over 5 years, during which conventional ROI metrics show little or no positive return. Yet, once a new drug is approved, it can yield substantial long-term profits and strategic value.

Short-term ROI pressure during this incubation period often causes companies to hesitate or underfund such transformative projects, despite their potential for high future payoff. In short, ROI focused on immediate returns can undervalue long-horizon innovation investments, leading to missed breakthrough opportunities.

Intangible Impacts

Innovation drives more than direct revenue. It also drives cultural shifts, promotes organizational learning, builds strategic positioning, and enhances customer relationships. However, financial ROI metrics fail to capture intangible benefits.

For example, consider Google, which invests in new workplace culture initiatives to encourage creativity and collaboration. The immediate financial return may not be visible. Yet, this cultural shift leads to higher employee motivation, faster problem-solving, and stronger market positioning over time.

57% of IT leaders reported digital investments significantly boosted employee productivity and satisfaction. Overall, neglecting intangible impacts leads to undervaluing the actual impact of innovation.

Consequence

An over-reliance on ROI can lead to what is sometimes referred to as "innovation theater.” It implies that the organization invests resources in projects that appear impressive in presentations but fail to deliver impactful business value.

For example, IBM's six-year struggle to launch the PC was resolved only when the chairman created a protected "habitat" (Project Chess). It gave the small and independent team freedom to bypass company rules. This team operated independently of headquarters and utilized external components. As a result, IBM had a successful launch of its PC in 1981. This demonstrated that even large companies can innovate by allowing flexibility and risk-taking without being overly concerned about ROI.

For example, some organizations hold frequent innovation workshops without a clear follow-up plan or proper resources. This results in many ideas, but few that ever reach the market or have a significant impact on the business. These events generate goodwill and buzz but fail to deliver tangible outcomes.

In short, the phenomenon of "innovation theater" creates the illusion of innovation rather than delivering substantive value.

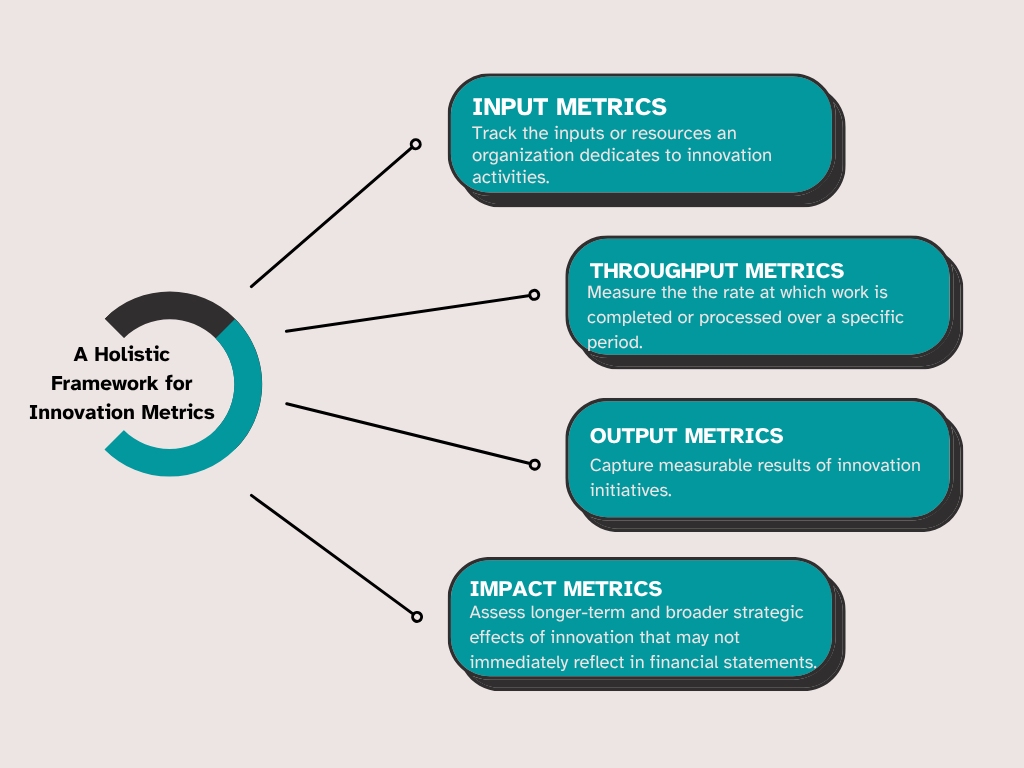

A Holistic Framework for Innovation Metrics

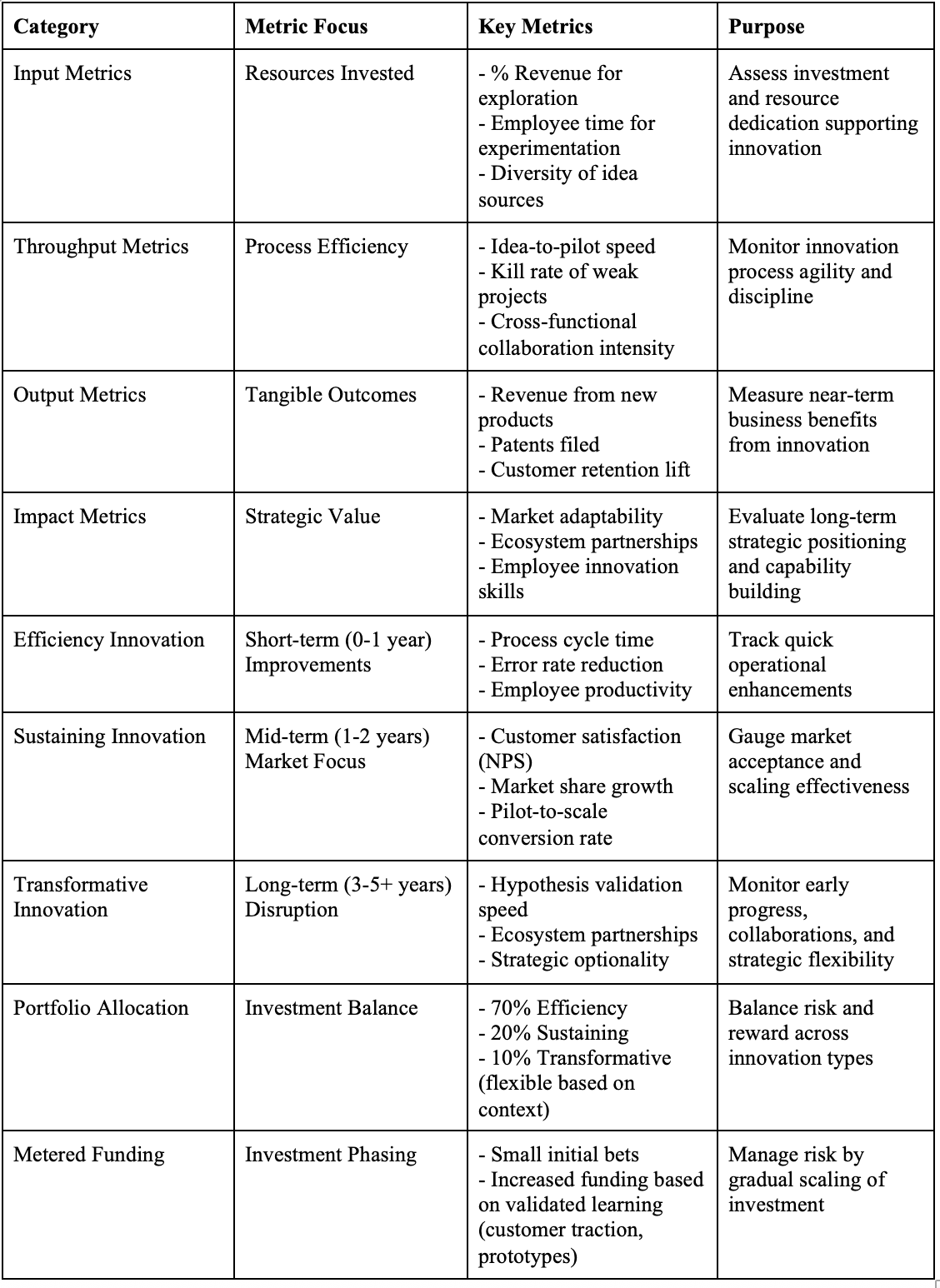

A holistic framework for innovation metrics involves adopting a "Return on Innovation" portfolio approach that measures success across multiple interconnected dimensions. This approach goes beyond traditional financial ROI. It recognizes that innovation requires diverse metrics that reflect resources, processes, outcomes, and strategic value.

Input Metrics (Resources Invested)

Input metrics track the inputs or resources an organization dedicates to innovation activities. These metrics include:

Percentage of revenue allocated to exploration and innovation projects.

Employee time specifically set aside for experimentation and idea development.

Diversity and variety of idea sources, such as contributions from cross-functional teams or external partners.

Measuring these inputs helps ensure adequate investment and supports balanced innovation efforts.

Throughput Metrics (Process Efficiency)

Throughput metrics measure the rate at which work is completed or processed over a specific period. These metrics are effective in evaluating efficiency and capacity. The metrics include:

Idea-to-pilot speed

Kill rate of weak projects

Cross-functional collaboration intensity

Output Metrics (Tangible Outcomes)

Output metrics capture measurable results of innovation initiatives. These metrics highlight direct or near-term business benefits stemming from innovation efforts. The metrics include:

Revenue generated from new products or services launched within a given period

Number of patents filed, or intellectual property created

Customer retention lift or improvements in market share attributable to innovation

Impact Metrics (Strategic Value)

Impact metrics assess the longer-term and broader strategic effects of innovation that may not be immediately reflected in financial statements. These measures demonstrate how innovation enhances competitive positioning and fosters capabilities for sustained success. These metrics include:

Market adaptability and the organization's ability to respond to shifting trends or disruptions.

Strength and number of ecosystem partnerships that enable co-innovation and expanded reach.

Development of employee innovation skills and enhancement of innovation capacity throughout the organization.

Together, these four metric categories form a balanced portfolio that captures the multifaceted nature of innovation. You can select and customize metrics within these categories for personalized innovation measures.

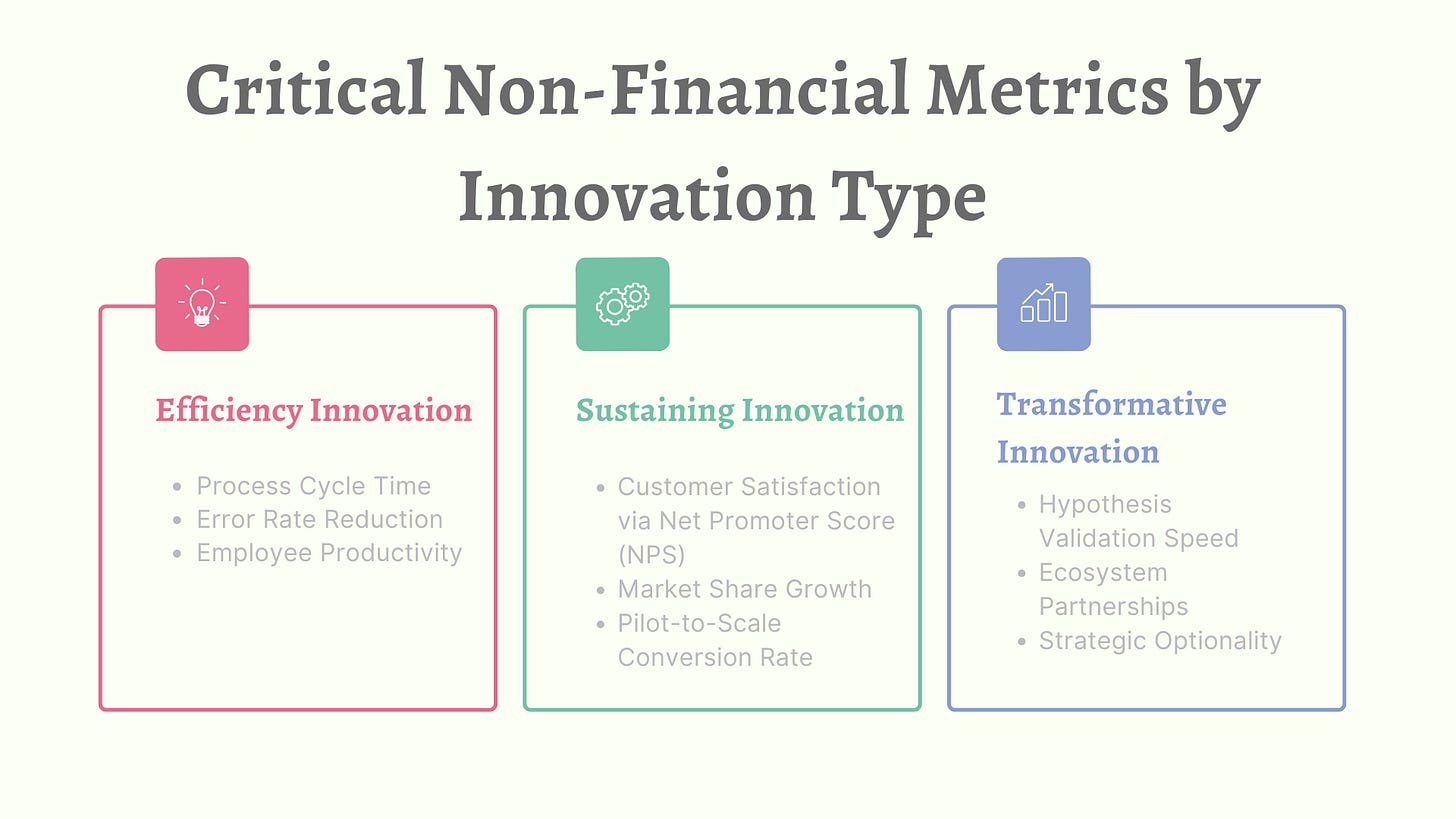

Critical Non-Financial Metrics by Innovation Type

Innovation success varies with its type. Different types of innovation projects require distinct non-financial metrics to track progress and impact effectively. Let's discuss the main types of innovation and their critical non-financial metrics:

Efficiency Innovation (0–1 year horizon)

Efficiency innovation focuses on improving existing processes and operations to enhance productivity and reduce errors within a short timeframe. Key non-financial metrics include:

Process Cycle Time: Measures how quickly a process completes, indicating operational efficiency improvements.

Error Rate Reduction: Tracks decline in defects or mistakes to reflect quality enhancements.

Employee Productivity: Assesses outputs relative to labor input to show gains from streamlined workflows or automation.

These metrics help organizations ensure that incremental innovations are delivering tangible operational benefits.

Sustaining Innovation (1-2 years horizon)

Sustaining innovation strengthens and extends existing business models to enhance products/services or expand market reach. Key non-financial metrics include:

Customer Satisfaction via Net Promoter Score (NPS): Gauges how well innovations meet customer expectations and build loyalty.

Market Share Growth: Indicates an improvement in competitive positioning driven by innovations in offerings or delivery.

Pilot-to-Scale Conversion Rate: Tracks the success of moving tested innovations into full-scale deployment to reflect execution effectiveness.

These measures focus on market acceptance and internal scaling capabilities, which are essential to sustaining innovation.

Transformative Innovation (3-5+ years horizon)

Transformative innovation aims to create new markets by introducing groundbreaking products, services, or business models. The target is to disrupt existing industries or develop entirely new customer segments. Key non-financial metrics include:

Hypothesis Validation Speed: Reflects how rapidly new concepts are tested and validated.

Ecosystem Partnerships: Measures the development of collaborative networks that extend innovation capacity and market reach.

Strategic Optionality: Evaluates the range of future strategic opportunities enabled by innovation, indicating flexibility to adapt or pivot.

These metrics enable organizations to track early-stage progress and long-term strategic positioning, extending beyond immediate financial returns.

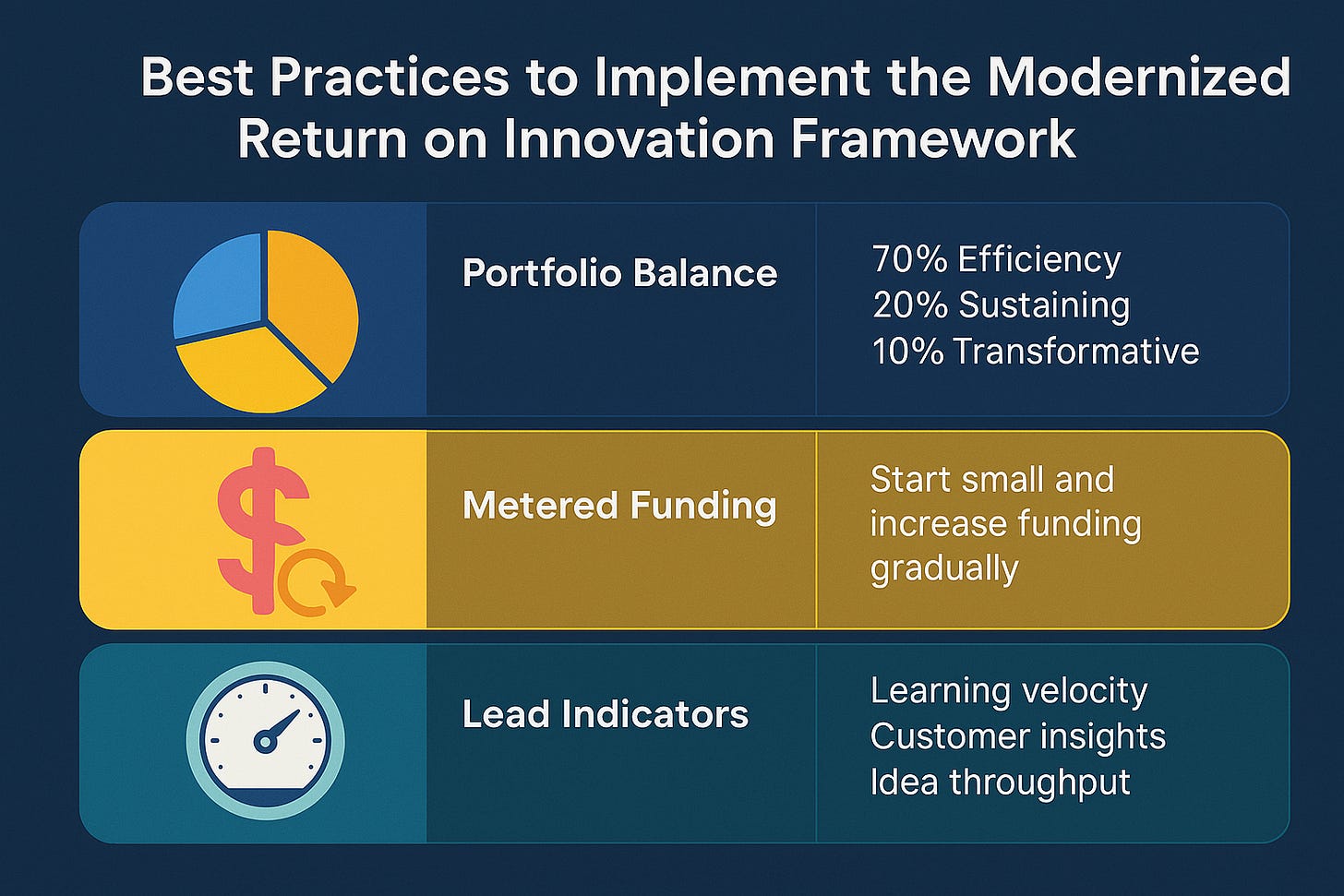

Best Practices to Implement the Modernized Return on Innovation Framework

Since ROI alone isn't enough for innovation projects, a balanced approach combining financial and non-financial metrics is essential.

Now that we know about the innovation metrics to track from the above discussion, let's discuss the best practices to implement the modernized return on innovation framework:

Portfolio Balance

A successful innovation portfolio allocates investments wisely across different innovation types to balance risk and returns:

70% to Efficiency Innovations, which improve existing processes and generate near-term returns.

20% to Sustaining Innovations, aimed at enhancing products or markets with a 1–2 year horizon.

10% to Transformative Innovations, which are high-risk and high-reward efforts that take 3–5+ years to mature but can create new markets or business models.

It isn't necessary to follow the above division. Perhaps your existing operations are already efficient, allowing you to allocate more investment to sustaining and transformative innovations.

Metered Funding

Instead of large upfront bets, start with small and incremental investments in multiple innovation initiatives. Increase funding gradually based on validated learning signals such as:

Customer traction or adoption rates

Prototype feedback and testing outcomes

Experimentation progress and early milestones

This approach mitigates risk by filtering out non-viable projects early and optimizing resource allocation to the most promising ideas.

Lead Indicators

Lead indicators track early actions or behaviors that predict future success in innovation. They help organizations measure progress before financial results appear.

Key metrics include:

Learning Velocity: Number of experiments or tests conducted per week to accelerate knowledge generation.

Customer Insights: Gather early feedback on prototypes or pilot offerings to assess market fit.

Idea Throughput: Speed of moving concepts through development stages.

Focusing on these indicators helps organizations stay agile and responsive.

Case Study of Modernized Return on Innovation Framework

A prominent example of practical implementation is how companies like Tesla manage their innovation portfolios. Tesla balances incremental product improvements (efficiency and sustaining innovations) with long-term bets on transformative innovations such as battery technology and autonomous driving.

They apply a phased funding approach, intensifying investment as milestones are achieved, and utilize lead indicators, such as prototype testing success and customer feedback, to guide development. This holistic and adaptive framework enables Tesla to maintain its leadership in innovation within the industry.

Summary and Example of Key Innovation Metrics Beyond ROI

Let's assume that a company decided to develop and launch a Smart Energy Management System (SEMS) aimed at industrial clients to optimize energy use and reduce carbon emissions.

Input Metrics:

Allocated 15% of the annual R&D budget specifically for SEMS development.

Dedicated 20% of the product team's time to prototype creation and market research.

Ideas sourced from internal engineers, energy consultants, and external academic partners.

Throughput Metrics:

Reduced time from ideation to functional prototype from 12 to 8 months by improving cross-team collaboration.

Implemented a kill process and discontinued 30% of SEMS feature ideas after early testing showed limited customer value.

Held bi-weekly innovation workshops to improve interdisciplinary knowledge exchange.

Output Metrics:

Achieved pilot deployment with three major industrial clients, which led to the generation of $2M in new revenue within the first 18 months.

Filed 10 patents related to energy optimization algorithms and hardware design.

Improved customer retention by 7% due to enhanced system performance and savings.

Impact Metrics:

Increased market adaptability by launching firmware updates quarterly to respond quickly to client feedback and regulatory changes.

Established partnerships with five utility companies and technology providers to co-develop features and expand deployment.

Trained 60% of R&D staff in advanced energy systems and AI-based analytics to build future innovation capacity.

Innovation-Type Specific Metrics:

Efficiency Innovation: Shortened system diagnostic cycle time by 20% and reduced error rates in energy reporting modules by 25%.

Sustaining Innovation: Raised customer satisfaction (NPS) by 15 points through user interface enhancements and grew market share in industrial sectors by 5%.

Transformative Innovation: Increased hypothesis validation speed by conducting four experimental field tests per quarter and built an ecosystem of 8 technology partners.

Lead Indicators:

Conducted 18 experiments per month on energy-saving algorithms.

Doubled customer feedback sessions during pilots.

Accelerated idea throughput by 30% to shorten decision cycles from concept to testing.

In short, all the above metrics reflect that innovation projects need more than just traditional financial measures. They require a balanced approach that combines diverse non-financial indicators and lead signals to manage effectively.

Emerging Trends About Innovation ROI

Innovation ROI measurement is evolving in response to technological advancements and shifting societal priorities. Check out the below emerging trends shaping how organizations assess innovation returns beyond traditional financials:

AI-Driven Innovation

AI technologies are becoming central to innovation projects, which urges the need for specialized metrics, including:

Algorithm Bias: Ensures AI models make fair and unbiased decisions.

Human-AI Collaboration Quality: Assesses how effectively AI tools augment human work rather than replace it.

Ethical Adherence: Tracks compliance with ethical AI principles and regulations.

Strategic Intelligence

Strategic intelligence is also gaining attention today, as it reflects how effectively an organization leverages market and competitive insights to enhance decision quality and align innovation efforts. It tracks:

Speed and Confidence of Strategic Decisions: How quickly and decisively an organization makes high-impact decisions using data and insight.

Identification of New Opportunities: The ability to detect emerging market trends, technological shifts, and unmet customer needs early to capitalize on potential innovation areas.

Integration of External Innovations: The process of incorporating solutions, technologies, or partnerships from startups or external sources to achieve quick wins and complement longer-term transformative innovation efforts.

Sustainability

Sustainability metrics are becoming increasingly integral to innovation ROI, as organizations address environmental, social, and governance (ESG) goals. Key measures include:

Carbon Footprint Reduction: Measures the decrease in greenhouse gas emissions from innovation initiatives.

Circular Economy Contributions: Tracks efforts to reuse, recycle, and minimize waste.

Social Impact: Assesses the positive effects of innovation on communities, employee well-being, equity, and broader societal benefits.

Conclusion

Measuring the true value of innovation requires more than just traditional ROI formulas. Organizations should use a combination of financial and non-financial metrics that capture the uncertainties and long-term effects inherent in innovation. Focusing on this comprehensive measurement approach enables leaders to make informed decisions and ensures that innovation efforts yield sustainable growth. Start rethinking your innovation metrics now to secure your organization's future.

Love this article and especially its inclusion of sustainability! and it is interesting to hear that major companies are including emissions reduction and trust metrics as part of how they measure success.